Benefits might change for self-initiated settlement. You’ll normally have the simplest time negotiating as soon as a stability has absent to collections (though it is feasible to negotiate with a lender or creditor ahead of a equilibrium reaches that phase).

The calculator below compares the quantity you owe on vital debt kinds for your gross annual revenue (whole pay back prior to taxes or deductions) and suggests which payoff method could get the job done greatest to your circumstance.

Understand that there is not any ensure the organization should be able to get to a debt settlement settlement for all of your debts.

Understand that settling an account should have a negative effect on your credit scores. Even when you've generally paid out your Monthly bill punctually, settling an account signifies it was not repaid as agreed. A settled account remains with your credit report for 7 yrs, even so the damaging outcome it's got on your own scores can reduce eventually.

“Should you have 5 or 6 creditors and the corporation settles one of those debts, they will begin charging a payment as soon as they get a result,” McClary claims.

Consider how Every single debt aid application can impression your credit and how much time it might continue to be with your credit report.

That said, you may take into consideration forbearance as an alternative to lacking a payment. Don't forget, though, that payments are not documented late until finally thirty times after the thanks date, so you will have a while to return up with a means to pay back your Invoice.

In the event your claim is taken to court docket, then there are numerous files which have been required to substantiate your assert. This includes a duplicate on the deal, applicable stipulations, get confirmation, proof of supply, invoices and a copy of your correspondence with your debtor. If added files are necessary, your caseworker will advise you.

Depending on your predicament, you might require to test to negotiate with one or more credit card companies. Just take inventory of the credit card debt by logging in to your on the net accounts and tallying up your present-day balances.

If you are guiding with Settle loan your credit card payments, It can be doable to negotiate the quantity you owe. You can negotiate your credit card debt through forbearance, a exercise settlement, a debt management system or debt settlement.

There generally is a couple professionals to debt settlement, but it is best to cautiously think about the likely negatives of debt settlement at the same time.

Our debt collection strategy commences inside the amicable phase without courtroom intervention initial, followed by lawful action on your ask for. Our technique is always agency and respectful, and you simply will always be educated in the position of your scenario.

You ought to take into consideration debt relief if paying out off your unsecured debt like credit card payments, personal loans and medical debt within five years isn’t feasible or Should your overall amount of unsecured debt equals 50% or more of the gross money. Here are a few forms of debt relief:

As you work to eliminate your credit card debt, it's also essential to consider ways to prevent taking up more of it in the future. Here are some recommendations that will help you complete your goal:

Val Kilmer Then & Now!

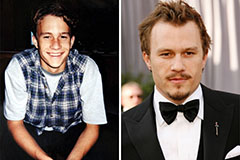

Val Kilmer Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!